__________________________________________________________________________________________________________

_______________________________________

_______________________________________

|

Over the last decade, the world around us has transformed from “There is a Time and Place for Everything” to “Everything – Anytime, Anywhere”. Not surprisingly then, for a planet which adds six million new souls each day, we are generating unstructured data bearing unimaginable diversity and in immeasurable measure, around our everyday actions, at unfathomable speeds. Therein lay the seeds to the creation of the term ‘Big Data’ – characterized by the Volume, Variety, Veracity and Velocity of the data involved. Simultaneous advancements in the computational technology have brought forth the hitherto untapped opportunity to analyze large data pools, both historic as well as contemporary (live), to derive meaningful correlations, trends and patterns of information vital to the seat of decision-making in the field of context. The unstructured data for Capital Markets and Investment Management industry is far more complex than any other. Its varied sources comprise of reference data (live tick data, exchange data, corporate actions etc), fundamental data (financial statements, analyst reports), transaction / market data (orders, trades, |

_

'Like' This Article _

Other Downloads |

|

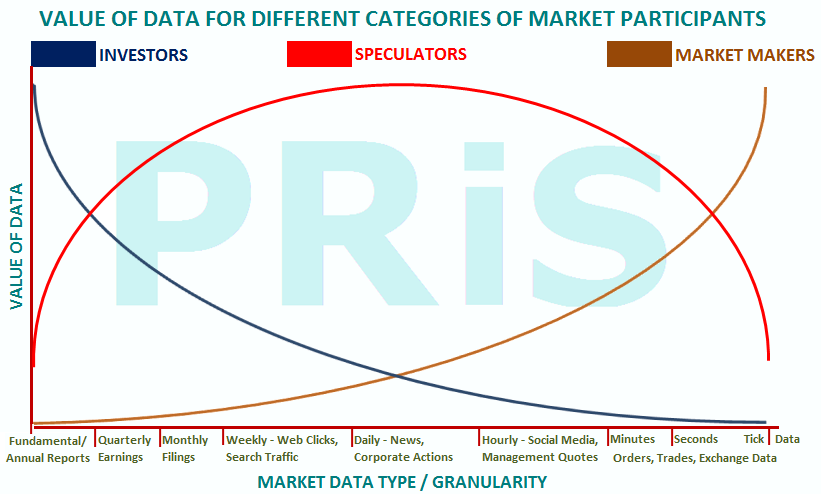

That brings us to the subject matter of the present article – How does the world of Big Data impact Small Investors? Do they have reason to be happy or fearful in the new investment scenario? Can they tap into the opportunity pool of Big Data? Before we attempt to answer any of the above, let us first understand the value of data for the different categories of market participants as depicted in the figure above. Typically, Investors value the fundamentals of their investments as far more strategic to their objective of long-term gain, while Speculators base their trading strategies around short-term tactical developments, news-bites social media buzz et al. Thus, algo-trading based on tapping the intra-day price movements at the fastest possible speed, is far more critical to the operations of the latter. |

|

The tech-savvy Small Investors willing to spare some time and money to leverage Big Data can look at the various available algo-trading platforms like Datasift*, Quantopian*, Finsents* et al along with established data visualization tools like Tableau and high-speed financial analytics applications like InTenMin*. These and many other similar upcoming players, claim to offer the ability to correlate real-time market/stock data with the sentiment buzz originating from social media to provide a holistic analysis that facilitates creation of customized algorithms for high-frequency trading. However, Small Investors must in advance realize the effort required to transcend the learning curve as well as the perils of working with such relatively new platforms and technologies.

And even the uninitiated Small Investors have nothing to fear from their lack of participation in the Big Data treads either, so long as they base their investment decisions on the time-tested philosophy of Benjamin Graham that stresses on minimal debt, fundamental analysis, buy-and-hold strategy, investing with a margin of safety, adopting portfolio diversification, contrarian views etc. These Grahamian investment principles remain largely unaffected over the medium to long term by the temporary inefficiencies that arise in the market as a result of investment fads, tech trends, natural or man-made calamities, political turmoils etc. For example, Investors who exited the markets during the financial crisis of 2008, due to either a lack of conviction in their investment strategy or a not-so-astute attempt to time the market bottom, lost big; those who stayed invested reverted to their long-term returns average over the next few years; while those who enhanced their play on lucrative opportunities the market offered during that time made a fortune! ____________________________________ *PRiS does not recommend or disfavor any of these or related technologies, applications and platforms. We have not made any independent attempt to verify the accuracy, efficiency or benefits of any particular algo-trading technology, method or tool that claims to leverage Big Data Analytics for a desired investment outcome. Investors must conduct their own independent research and/or consult their Investment Advisor for the suitability of such investment strategies/tools for their individual portfolios. |

__

_

_

_This site is best viewed in Firefox browser (ver. 8.0.1 or later)

Disclaimer: PRiS does not guarantee any specific financial returns, business outcome or market performance based on its research and advisory services.

Disclaimer: PRiS does not guarantee any specific financial returns, business outcome or market performance based on its research and advisory services.