__________________________________________________________________________________________________________

_______________________________________

_______________________________________

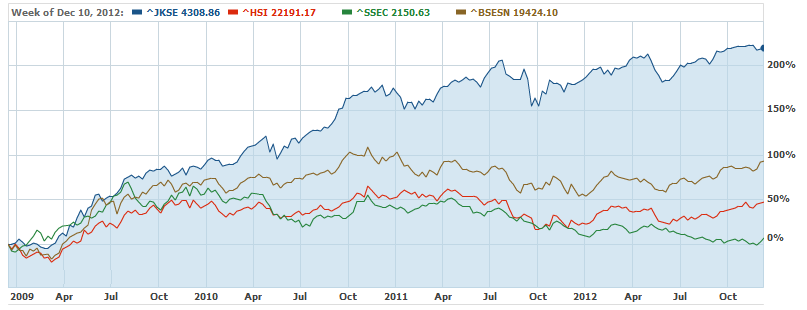

Surpassing the rhetoric of its twin deficits, slowing growth, falling exports et al, it is now apparent that India’s Financial Leaders are also tending to lead its economy away from the volatility of international trade flows (as in Thailand or Taiwan) by treading onto a proven success model of its more fiscally prudent Asian cousins like Indonesia. From being a nation bailed out by the IMF in the late nineties to pledging of a billion dollars to IMF’s kitty recently, Indonesia has really come a long way in a very short span of time. Global Investors’ interest has been continuously growing in Indonesia since 2009, while growth has moderated in its larger Asian peers – China and India, in recent years. Indonesia’s strong out-performance (see figure below), as evident from its most stables growth rates over the past 20 quarters, was a result of its fiscal prudence and stable governance, complimented by a conscious drive to clean corruption and success in executing public-private partnerships. |

_

'Like' This Article _

Other Downloads |

|

Performance of Jakarta Composite, Hang Seng, Shanghai Composite and BSE Sensex Indices since 2009 Source: PRiS

|

|

|

|

To get the complete article mail us at [email protected]

|

__

_

_

_This site is best viewed in Firefox browser (ver. 8.0.1 or later)

Disclaimer: PRiS does not guarantee any specific financial returns, business outcome or market performance based on its research and advisory services.

Disclaimer: PRiS does not guarantee any specific financial returns, business outcome or market performance based on its research and advisory services.